Student Loans with Ascent Cosigned

Welcome to Ascent. Ascent offers two great private student loan options to help you go to college for the first time or allow you to finish out your last couple of semesters. On this page, we will be breaking down the Ascent Cosigned Loan product they offer. A Cosigned Loan is a private student loan that requires the use of a cosigner. This loan is essentially designed with your family in mind and makes it easy for almost anyone to be able to acquire a loan from Ascent assuming you meet the minimum requirements which we will touch on later along with your cosigner. With this in mind, Ascent allows you to essentially customize your loan to fit your needs.

Ascent Cosigned Loan offers competitive rates for both fixed and variable interest rates for their loans. The borrower must make twelve (12) consecutive full principal and interest payments on time or an equivalent prepayment amount and meet other criteria (see attachment for more information). Ascent Cosigned Loan has one of the lowest loan minimums of just $2,001.00 and goes all the way up to $400,000.00 (aggregate) if needed. They also provide you with flexible repayment terms of 5, 7, 10, 12, or 15-year repayment options (Variable rates are not offered at the 15-year term). They also offer unique repayment options that you may not find with other private student loan lenders. One option they offer is In-School interest-only payments. This means that you will only pay for interest while you are in school, then start paying the interest + principal after you have completed school. The other option they have is Deferred Repayment, which offers a grace period of up to 9 months for undergrad and for graduates, this varies depending on the length of the program and the study. Finally, Ascent now offers a 1% Cash Back Reward upon satisfaction of certain terms and conditions. If you are curious about what a repayment option would look like, check out this super helpful link they offer: Ascent Cosigned.

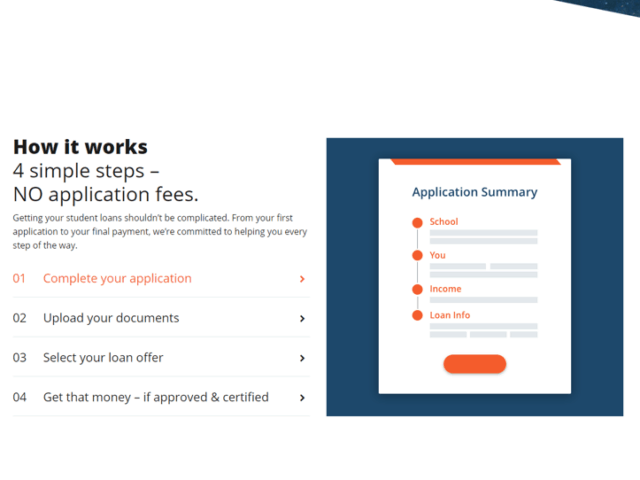

As you can see from some of the highlighted information above, Ascent really does stand out when it comes to private student loans. They have some key features which may sway you in the direction of taking out a loan with them items such as; auto pay discount when using automatic debit, no origination, disbursement, or loan application fees just to name a few of the many outstanding features they offer.

The Ascent Cosigned Loan Advantage

Lender

Ascent Student Loans

Eligible Degrees

Graduate & Undergraduate

Loan Terms

5, 7, 10, 12, 15 years

Variable Loan

Rates from 6.16% – 15.59% APR (w/ automatic payment)

Fixed Loan

Rates from 4.53% – 15.36% APR (w/ automatic payment)

Terms

APR Examples